Investment in Indonesia is gaining stronger traction as Australia accelerates its efforts to channel capital into high‑potential sectors across the archipelago. Five years after the implementation of the Indonesia–Australia Comprehensive Economic Partnership Agreement (IA‑CEPA), both countries aim to unlock broader cooperation and improve investor confidence.

Australia Deepens Investment Commitments

Australia recorded a significant increase in foreign direct investment into Indonesia. According to Austrade, Australian investment rose 30 percent in 2024, positioning Australia as Indonesia’s 11th‑largest source of foreign capital. Total Australian investment reached 1.36 billion Australian dollars, while Indonesian investment in Australia stood at 1.42 billion Australian dollars.

This surge reflects stronger momentum as more Australian companies expand their regional presence. Austrade CEO Paul Grimes emphasized the importance of strengthening business connections, stating, “We will push investment into Indonesia. We need to build relationships between Australian companies and Indonesia, and understand that market.”

Read More: Australia-Indonesia Partnership Strengthens in Pacific Region

Sector Priorities for Investment in Indonesia

Australia sees wide‑ranging opportunities across Indonesia’s growing economy. Austrade identified several key sectors where Australian businesses show increasing interest:

- Clean energy and the broader energy‑transition supply chain

- Mining equipment, technology, and services

- Education and vocational training

- Agrifood and livestock

- Healthcare services and specialty treatments

- Tourism, logistics, and real estate

- Data centers and digital infrastructure

Major Australian firms have already expanded operations in Indonesia. Notable examples include ICON Cancer Centre at Bali International Hospital, Gelflex, Austin Engineering, Cochlear, and Canva.

Policies Supporting Cross-Border Investment

Australia continues to strengthen its strategic framework for regional engagement. Its program, Invested: Australia’s Southeast Asia Economic Strategy to 2040, aims to support businesses seeking long‑term expansion. The Indonesia Deal Team plays a central role in identifying opportunities and linking them with Australian investors, including superannuation funds that collectively manage 4.4 trillion Australian dollars.

Grimes noted the importance of knowledge transfer within the business community, stressing that successful companies should share their insights to help others recognize Indonesia’s potential.

Growing Interest from Australian Investors

Australia’s government views Indonesia as a strategic partner with substantial long‑term prospects. Assistant Minister for Foreign Affairs and Trade Matt Thistlethwaite highlighted the importance of transparency in the region, stating, “Providing certainty and understanding about how the business environment works is very important. For Southeast Asia in general, corruption‑free governance is essential so that investors have confidence that when the government makes a decision, that decision will be followed.”

He emphasized that Indonesia offers more than a large consumer base or low‑cost labor. Thistlethwaite also noted that Australia appointed Jennifer Westacott as Indonesian Business Champion to identify and expand new investment opportunities. Additionally, programs such as the Southeast Asia Investment Financing Facility (SEAIFF), valued at 2 billion Australian dollars, aim to support infrastructure development.

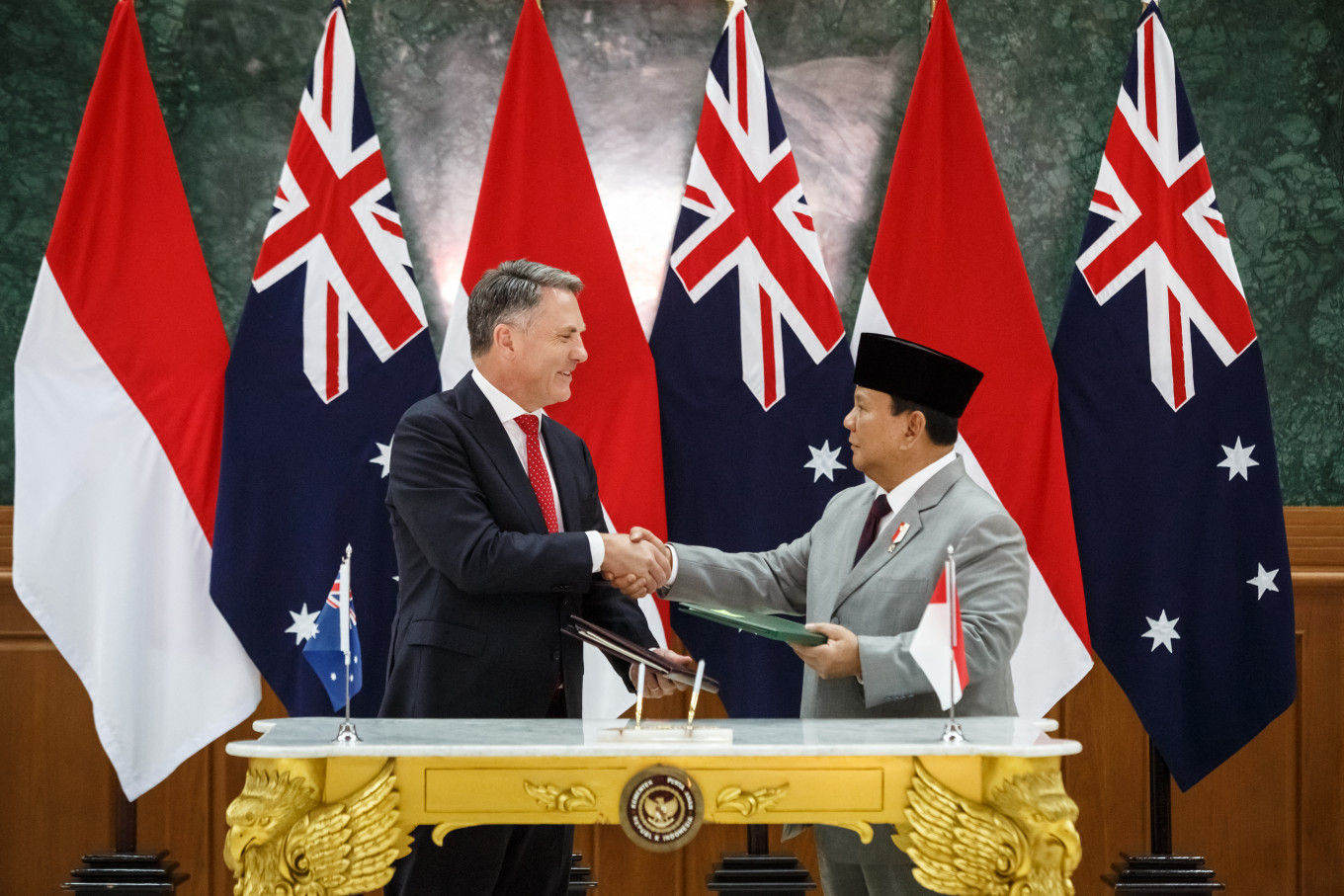

Read More: Indonesia, Australia Agree to Grow Two-Way Trade and Investment

Major Projects Under Exploration

High‑level engagements continue to strengthen bilateral investment momentum. During a recent working visit to Australia, Indonesia’s Minister of Investment and Downstreaming Rosan Roeslani met with executives from major Australian companies. The discussions focused on several strategic projects, including:

- Aspen Medical’s plan to redevelop Samarinda General Hospital with a value of US$1 billion

- Pure Battery Technologies’ planned US$350 million investment in cathode‑material production at Batang Industrial Park

- AAM Investment Group’s expansion of cattle‑farming operations in Lampung and involvement in IA‑CEPA workforce‑training programs

- Cue Energy Resources’ additional investments in the oil and gas sector

- Nickel Industries Ltd’s expansion of nickel‑processing facilities in Indonesia

Rosan reinforced Indonesia’s commitment to green and value‑added industries, stating, “Indonesia is ready to transform into a green and value‑added investment hub in the regional area.”

Strengthening Long-Term Bilateral Investment

Australia’s renewed commitments reflect a growing recognition of Indonesia’s economic potential. Both governments continue to remove investment barriers, promote transparency, and support private‑sector cooperation. As more companies engage with Indonesia’s diverse opportunities, bilateral ties are set to deepen further, paving the way for stronger and more sustainable growth across both economies.

Source: ekonomi.bisnis.com

Image: AFP / Devi Rahman